Buying your first home in 2025 isn’t just expensive, it feels out of reach. Even after years of saving, cutting expenses, and doing everything “right,” many renters find themselves thousands short of what it takes just to get through the front door.

Here’s the reality:

- The median home price in the U.S. is now $414,000 (NAR, April 2025).

- First-time buyers typically put down 9%, which means about $37,000 in upfront cash.

- The average 30-year mortgage rate sits at 6.85% (Freddie Mac), nearly double what it was just a few years ago.

- Monthly rent has climbed to $2,024, up 35% since 2020 (Zillow).

- And with savings rates falling, fewer can even try, only 24% of recent homebuyers were first-timers, the lowest share in decades (NAR).

This study breaks down why the down payment is the biggest barrier to homeownership right now. We’ll look at what it really costs to buy your first home in today’s market, how long it takes to save, and why so many buyers feel stuck renting when they’d rather own.

Table of contents

- What Is a Down Payment, and Why It Matters in 2025

- Why Saving Feels Impossible: Prices, Rates, and Rent

- The Emotional Toll: Stress, Delays, and Real-Life Struggles

- Down Payments vs. Renting: A Cost Breakdown

- Should You Buy Now or Keep Saving?

- What the $37K Barrier Really Means

- Frequently Asked Questions

- Methodology

Instant Valuation, Confidential Deals with a Certified iBuyer.com Specialist.

Sell Smart, Sell Fast, Get Sold. No Obligations.

What Is a Down Payment, and Why It Matters in 2025

Before you can get a mortgage, you need to put money down. That’s the down payment, the upfront cash you pay toward the home’s price. It’s your initial ownership stake and a way to show lenders you’re serious.

Most loan types require at least 3% to 5% down, but in practice, first-time buyers in 2025 are putting down closer to 9%. According to the National Association of Realtors (NAR), that’s roughly $37,000 on a typical home priced at $414,000 as of April 2025.

Why the Down Payment Matters So Much

It’s not just about getting the loan. Your down payment affects everything that comes after:

- Monthly payments: The more you put down, the smaller your loan, and the less interest you’ll pay over time. Use this calculator from NerdWallet to see the difference.

- Private Mortgage Insurance (PMI): If you put down less than 20%, lenders typically require PMI, which can add hundreds to your monthly costs. The Consumer Financial Protection Bureau explains how PMI works.

- Loan approval: A larger down payment lowers risk for lenders. It can help you qualify for better rates or offset a lower credit score.

- Long-term equity: More cash up front means you own more from day one, and gives you a buffer if the market dips.

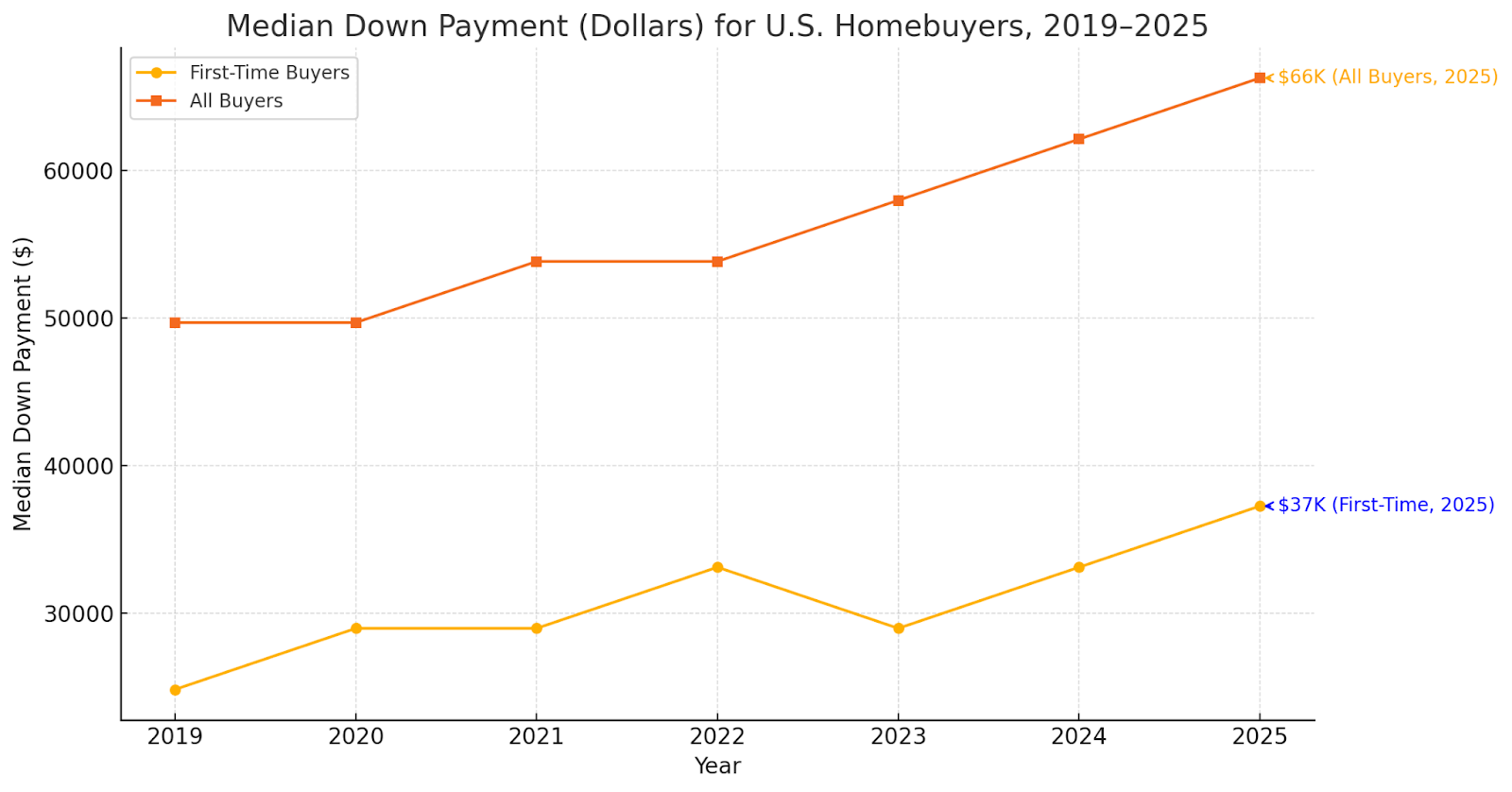

Down Payments by Buyer Type

| Buyer type | Typical down payment % | Cash needed on a $414,000 home |

| First-time buyers | 9% | $37,000 |

| Repeat buyers | 23% | $95,000 |

| All buyers | 16% | $66,000 |

Sources: NAR 2024 Profile of Home Buyers and Sellers; NAR Existing-Home Sales – April 2025

Repeat buyers often have equity from a previous sale to help cover their next down payment. First-time buyers don’t, and that’s what makes the upfront cost such a steep climb.

Renters are starting from scratch, often while paying record-high housing costs each month. And unlike equity-rich repeat buyers, they’re saving out of pocket, slowly, while inflation, rent hikes, and rising home prices move the target further away.

Even programs that allow lower down payments don’t make things easy. For example, FHA loans let some buyers put down just 3.5%, but that still means over $14,000 on a $414,000 home, not including closing costs, inspections, or moving expenses. Plus, with PMI added in, monthly costs stay high.

In 2025, the down payment isn’t just a financial hurdle, it’s the line between renting indefinitely and building equity. And for many first-time buyers, it’s the part that feels the most out of reach.

Why Saving Feels Impossible: Prices, Rates, and Rent

Saving for a down payment sounds simple, until you try to do it while renting in 2025.

For most first-time buyers, the biggest challenge isn’t qualifying for a mortgage. It’s scraping together enough cash to meet that $37,000 upfront hurdle, all while navigating rising living costs, stagnant wages, and expensive rent.

Home Prices Are Still High

Even though the housing market has cooled in some areas, prices remain near historic highs. The National Association of Realtors reports that the national median home price is $414,000 as of April 2025. That’s about 30% higher than in early 2020.

Why does this matter? Because the more home prices rise, the more your down payment needs to grow, especially if you’re trying to avoid PMI.

Mortgage Rates Aren’t Helping

After years of record-low rates, borrowing is now far more expensive. As of June 2025, Freddie Mac reports the average 30-year fixed mortgage rate is 6.85%.

That’s more than double the average in 2021.

Higher rates mean:

- Bigger monthly payments for the same home.

- Tighter lender requirements.

- In some cases, larger down payments, especially for buyers with moderate credit scores.

In short, rising rates don’t just hurt affordability, they make saving up in advance more important (and more difficult).

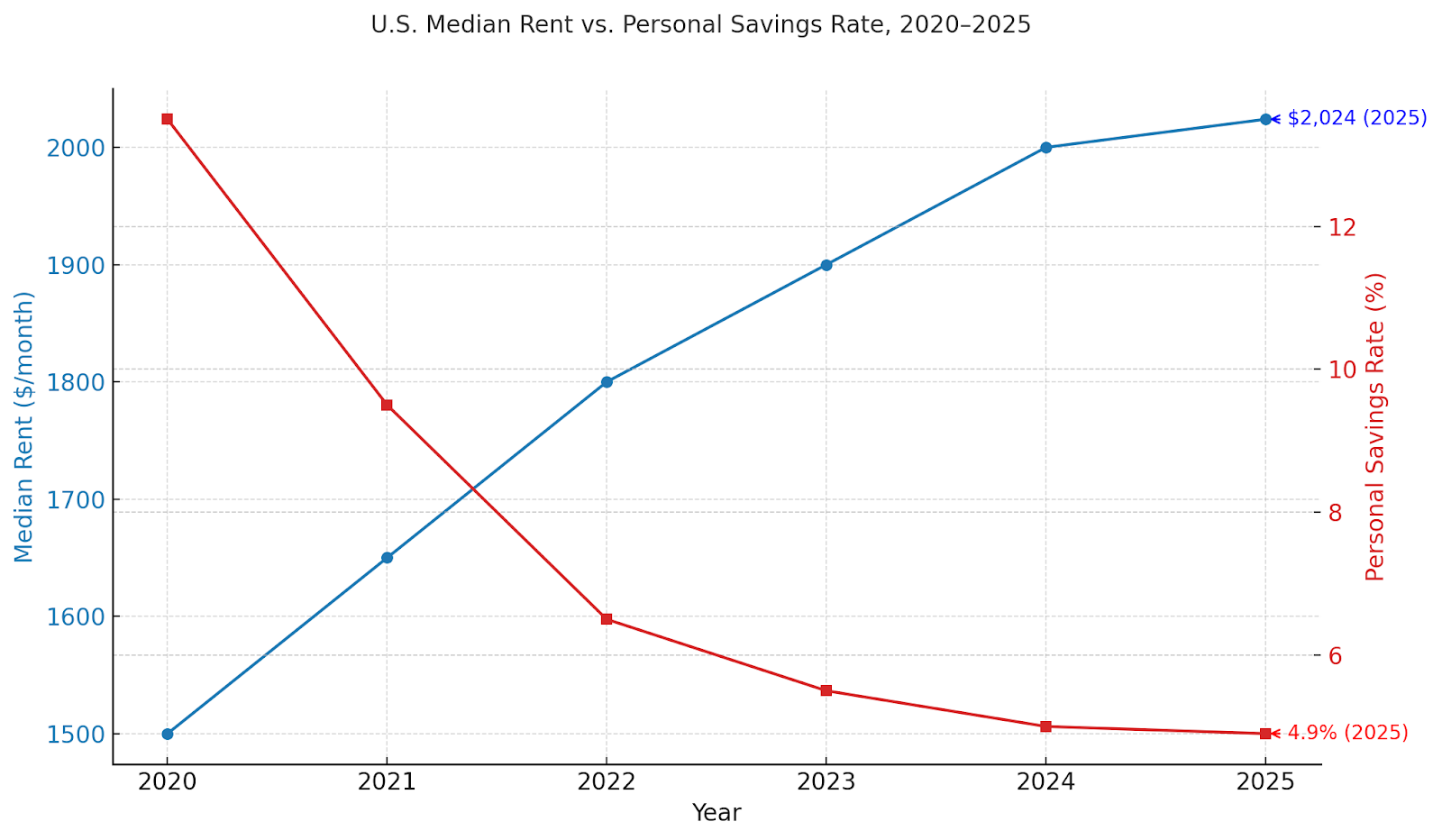

Rents Keep Climbing

The other half of the equation is rent. According to the Zillow Observed Rent Index, the median U.S. rent is now $2,024, up more than 35% since 2020.

That means over $24,000 per year is going to rent. For many households, it leaves little room to save.

To make matters worse, personal savings rates have dropped back to 4.9%, far below pandemic-era highs of 15% or more.

So even if your income is solid, you’re likely putting away far less than you need, and doing it far slower than the market demands.

The Emotional Toll: Stress, Delays, and Real-Life Struggles

The numbers tell one story, but the lived reality is even tougher. For most first-time buyers, saving for a down payment isn’t just a math problem. It’s a long grind that wears people down, delays major life steps, and leaves many feeling like homeownership is just out of reach.

Years Spent Chasing the Same Goal

Let’s break it down:

At the current median rent of $2,024/month, many renters can only save a few hundred dollars each month, if that. Even saving $500/month (which is more than most households manage) means it would take over six years to build a $37,000 down payment.

That timeline can stretch even further if:

- Rent goes up (again)

- Medical bills or emergencies hit

- Home prices keep rising while you save

Nearly three-quarters of first-time buyers report feeling discouraged by how slowly their savings grow compared to home prices.

Life Put on Hold

That kind of delay isn’t just a financial inconvenience. It often means putting off other life goals, like getting married, having children, or moving closer to family, just to keep saving. For many, the stress and uncertainty become a heavy burden.

Real People, Real Delays

Consider a couple earning the U.S. median household income (about $85,000). With monthly expenses and rising rent, saving even $500–700 per month is a stretch. Even with discipline, they’re looking at years of waiting, all while home prices and interest rates may creep up further.

It’s Not Just Money, It’s Momentum

In 2025, the emotional cost is real: feeling “stuck,” left behind by friends who already bought, and questioning whether homeownership is even possible anymore. For many, the down payment isn’t just a financial wall, it’s a psychological one too.

Down Payments vs. Renting: A Cost Breakdown

If you’re renting, you already know how fast money disappears each month. But how does the cost of renting stack up against what you’d need for a down payment?

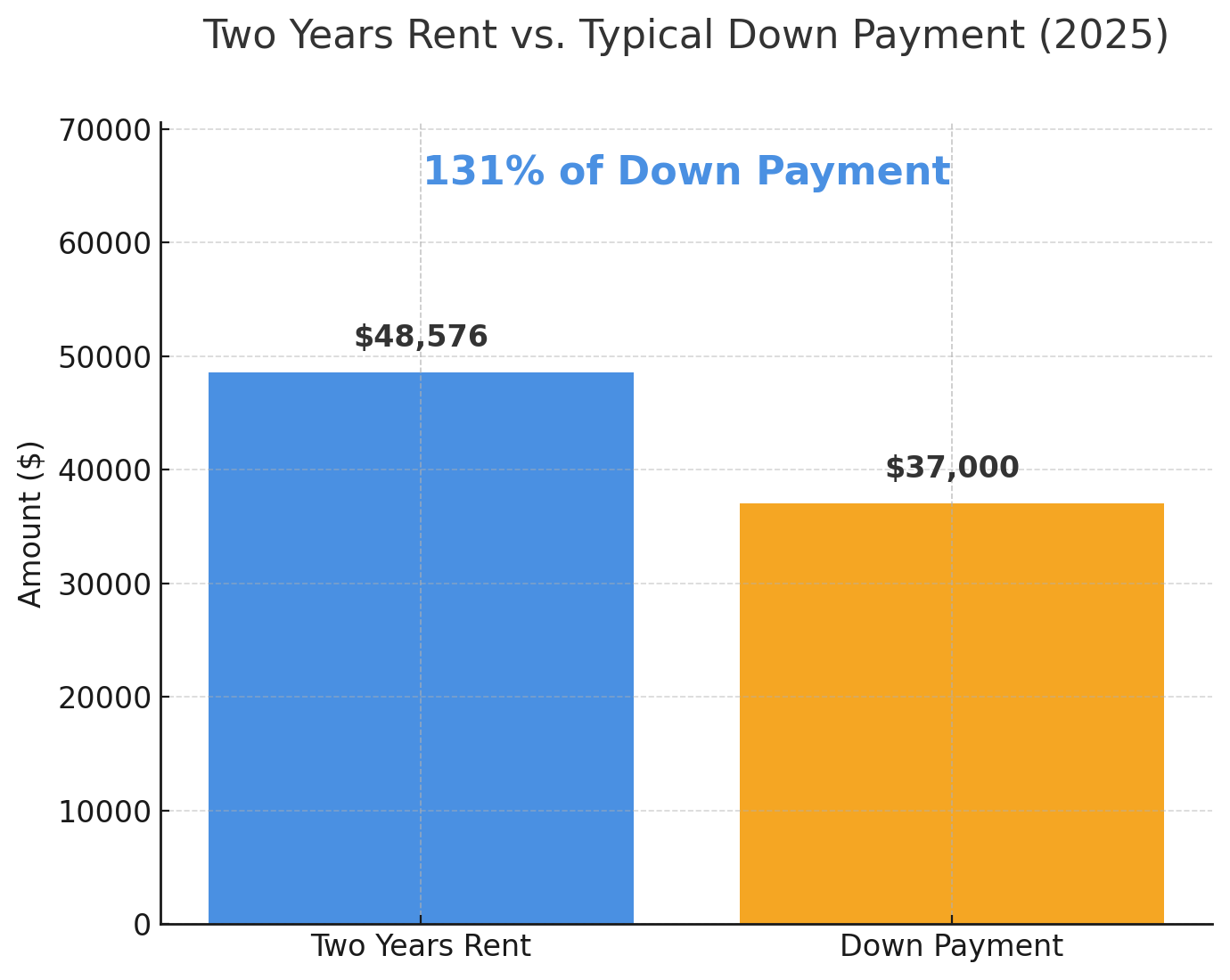

Two Years of Rent = More Than a Down Payment

Right now, the median U.S. rent is $2,024 per month. That’s about $24,300 per year, or $48,600 over just two years.

Compare that to the typical down payment for a first-time buyer in 2025:

- $37,000 upfront (9% of the $414,000 median home price)

In other words, the cash you spend on two years of rent is enough to cover a full down payment, and then some. Yet for most renters, saving that much while also paying rent just isn’t realistic.

Why Renting Feels Like a Trap

Every dollar spent on rent is a dollar that can’t go toward savings. Meanwhile, rent prices keep climbing, wages lag behind, and home prices rarely stand still. It’s a cycle that makes it harder each year for renters to close the gap and buy.

Buying Isn’t Easy, But It Changes the Game

Once you buy, you start building equity with every mortgage payment. Unlike rent, that money goes back into your future, not your landlord’s. Plus, buying can help stabilize your monthly costs, especially as rents continue to rise.

But none of that matters if you can’t get over the initial hurdle, the upfront down payment. That’s why so many would-be buyers feel stuck, even if the long-term math favors ownership.

Should You Buy Now or Keep Saving?

If the down payment is so tough, does it make sense to jump in now, or should you wait and save more? The answer depends on your personal finances, your local market, and your risk tolerance.

The Case for Buying Now

- Lock in a price: If home prices keep rising, buying now lets you build equity sooner and avoid future increases.

- Start building equity: Every mortgage payment goes toward something you own, not your landlord.

- Stabilize your housing costs: Fixed-rate mortgages protect you from rising rents.

But buying now means dealing with today’s high rates and prices. Your monthly payment could be steep, especially with average mortgage rates at 6.85% and little room for negotiation on price.

The Case for Waiting

- Save a larger down payment: More upfront cash means lower monthly payments and less (or no) PMI.

- Possibility of better deals: If the market slows, prices, or rates, could come down.

- Strengthen your finances: More time means more savings and maybe a higher credit score.

But waiting comes with risks too. Rents could keep rising, making it harder to save. Home prices might not drop, or could even rise faster than your savings.

Real-World Example

Suppose you save $500 a month. In a year, that’s $6,000 more for your down payment. But if home prices go up even 3% in that time (about $12,000 on a $414,000 home), you could actually fall further behind.

What the Experts Say

The National Association of Realtors suggests that, for many, buying sooner is better if you’re financially ready, since waiting rarely makes the process easier. NerdWallet notes that if your market is softening or your finances will improve a lot, waiting could pay off.

Bottom Line

There’s no perfect answer. The best move is the one that fits your budget, your job security, and your long-term goals. For most people, the right time to buy is when they can truly afford it, both upfront and every month after.

What the $37K Barrier Really Means

The down payment isn’t just a number, it’s the biggest obstacle between today’s renters and tomorrow’s homeowners. In 2025, with $37,000 required up front, high interest rates, and rising rents, the math just doesn’t add up for millions who want to buy.

But the dream isn’t dead.

What really matters now is strategy and perseverance.

Here’s what you can do:

- Automate your savings. Even small, regular deposits into a high-yield savings account can add up.

- Look for assistance programs. Many states and cities offer grants or low-interest loans to help with down payments, check HUD resources.

- Keep a close eye on your local market. Prices and opportunities vary; being ready to act when the time is right can make all the difference.

You may have to wait, save longer, or compromise on your first home. But if you’re proactive and realistic about what you can afford, you can still get there, even when the upfront barrier feels overwhelming.

Compare Cash Offers from Top Home Buyers. Delivered by Your Local iBuyer Certified Specialist.

One Expert, Multiple Offers, No Obligation.

Frequently Asked Questions

Most first-time buyers put down about 9% of the home’s price. With the current median price at $414,000, that’s roughly $37,000 upfront.

Yes. Programs like FHA loans let you put as little as 3.5% down. But if you put down less than 20%, you’ll usually pay private mortgage insurance (PMI) on top of your monthly payment.

For most buyers saving $500–$700 per month, it can take 4–6 years to save up a typical down payment. Rising rents and expenses make it harder to save quickly.

Yes, many states and cities offer down payment assistance programs, including grants and low-interest loans for first-time buyers.

Renting has a lower upfront cost and more flexibility, but it doesn’t build equity or protect you from rising housing costs. Over time, buying can offer more financial stability, if you can clear the down payment hurdle.

When you buy, your payments build equity and lock in your housing costs. Renting is more flexible but leaves you exposed to annual rent increases and offers no ownership.

Methodology

This article is based on the latest data from leading U.S. housing and economic sources. All figures are current as of Q2 2025 unless otherwise noted.

- National Association of Realtors (NAR): Existing-home sales and 2024 Profile of Home Buyers and Sellers provided data on home prices, down payment percentages, and buyer demographics.

- Freddie Mac: Primary Mortgage Market Survey (PMMS) was referenced for average 30-year mortgage rates.

- Zillow Research: Zillow Observed Rent Index (ZORI) was used for tracking national rent trends and rent inflation.

- Federal Reserve Economic Data (FRED): Personal savings rate and other economic indicators.

- U.S. Census Bureau: Median household income and demographic context.

- Additional sources include Money Magazine, NerdWallet, and local market reports for examples and scenario modeling.

Calculations such as time-to-save estimates, rent comparisons, and affordability scenarios were based on these published averages and median figures.

Reilly Dzurick is a seasoned real estate agent at Get Land Florida, bringing over six years of industry experience to the vibrant Vero Beach market. She is known for her deep understanding of local real estate trends and her dedication to helping clients find their dream properties. Reilly’s journey in real estate is complemented by her academic background in Public Relations, Advertising, and Applied Communication from the University of North Florida.