Want to sell your Florida home fast without repairs, showings, or waiting for buyer financing? You’re not alone. More and more homeowners are skipping the traditional process and choosing a faster, easier way—selling directly to a trusted cash buyer.

About 40.7% of homes in Florida were sold for cash, according to a report from Redfin. That’s a growing trend—and one that’s saving sellers time, money, and stress.

In this 2025 update, we’ve rounded up the 7 best cash home buyers in Florida—including iBuyer.com, which offers its own fast cash offer service.

Cash Offers in Florida

Compare Cash Offers from Top Home Buyers. Delivered by Your Local iBuyer Certified Specialist.

One Expert, Multiple Offers, No Obligation.

7 Best Cash Buyers in Florida

1. iBuyer.com

- Cash offers in 24 hours

- Close in 7-10 days

- Flexible closing date

iBuyer.com is a real estate platform that allows homeowners to sell their homes quickly and efficiently, eliminating traditional obstacles like listing agents, showings, and appraisals. With cash offers within a day, iBuyer.com is designed for convenience and speed.

- Easy Process: Create a free account, upload photos of your home, and receive a no-obligation cash offer within 24 hours.

- Fast Closing: Close the sale within 7-10 days based on your market, offering a much faster timeline than traditional sales.

- Streamlined Experience: Skip agent commissions, open houses, and the hassle of home appraisals.

- Competitive Offers: Receive a fair, market-based cash offer through iBuyer.com’s proprietary data analysis tools.

- Speed and Convenience: Sell your home without the delays and uncertainties of traditional real estate listings.

- No Repairs Needed: Sell as-is with no need to make updates, repairs, or clean before the sale.

- Flexible Closing Options: Choose a closing date that works best for you to minimize disruption.

- Accurate Home Valuation: Get a fast and precise home estimate using industry-backed data and real-time analysis.

- Transparent Pricing: Know what to expect upfront, with no hidden fees or unexpected charges.

iBuyer.com has a strong reputation, with an average rating of 4.3 stars on Trustpilot. Over 83% of reviewers give five-star ratings, highlighting iBuyer.com’s transparent pricing, seamless process, and attentive customer service. Customers frequently recommend iBuyer.com on Trustpilot for its reliable, efficient, and hassle-free home-selling experience.

iBuyer.com serves homeowners throughout Florida, including cities like Daytona Beach, Vero Beach, Tallahassee, and Miami, providing convenient, competitive cash offers for homes across the state. For a complete list, see all locations served by iBuyer.com.

2. Opendoor

- 5% Service Fee

- Offer in 24-48 hours

- Flexible closing date

Opendoor provides a hassle-free way to sell your home, eliminating traditional listing processes. They offer a competitive cash offer, allowing homeowners to skip showings and repairs.

- Fast Cash Offer: Receive a cash offer within 24-48 hours, expediting the selling process.

- Flexible Closing: Select a closing date that suits your schedule for a smooth transition.

- Transparent Fees: Includes a 5% service fee and about 1% in closing costs (title insurance, escrow, HOA fees).

- Repair Deductions: Costs for any major repairs are deducted from the total sale price.

Learn more about the process and how it compares to iBuyer’s offerings.

- Ease of Use: Sell quickly and avoid traditional listing hassles.

- No Showings or Repairs: Complete a video walkthrough or let Opendoor handle the property evaluation.

- Flexible Closing Dates: Choose your ideal closing date to fit your move timeline.

- Quick Cash Access: Fast cash offers mean you can secure funds quickly for your next purchase.

Opendoor holds an impressive 4.4-star rating on Reviews.io, with customers frequently praising the platform’s transparency and ease of use.

Opendoor serves major markets throughout Florida, including Miami, Orlando, Southwest Florida, and Tampa.

3. Offerpad

- 6% Service Fee

- 1% Estimated closing costs

- Cash offer in 24 hours

Offerpad provides instant cash offers on homes, allowing sellers to skip traditional listing steps.

- Quick Cash Offer: Receive an offer within 24 hours, expediting the home-selling process.

- Extended Closing Period: Sellers have up to 60 days to close, longer than the industry average.

- Fee Transparency: A 6% service fee and an estimated 1% closing cost, similar to other iBuyers.

- Quick Offer & Flexibility: Get a cash offer in 24 hours and choose your own closing date.

- Free Local Move: Enjoy professional moving services at no cost for distances up to 50 miles.

- Extended Stay: Take advantage of a three-day post-close option to stay in your home.

Offerpad has an average rating of 4.06/5 on its Better Business Bureau profile. Despite this rating, Offerpad maintains a strong A+ rating from the BBB, reflecting its commitment to customer service and transparency.

Offerpad operates in various Florida markets, including Fort Myers, Jacksonville, Orlando, and Tampa.

4. South Florida Cash Home Buyers

- Close in 7 days

- Cash offer in 24 hours

- No service fees

South Florida Cash Home Buyers offers a streamlined, hassle-free way to sell your home without the usual complications of listing, marketing, and showings.

- Fast Offer: Receive a fair, all-cash offer within 24 hours after initial contact.

- Flexible Closing: Close in as little as seven days, or choose a date that works for you.

- No Fees or Commissions: South Florida Cash Home Buyers covers all closing costs, making the process fee-free for sellers.

This approach allows homeowners to sell profitably and with no obligation to accept the offer if it doesn’t meet their needs.

- Fast, All-Cash Process: Receive cash for your home without listing or working with agents.

- No Fees: Unlike traditional sales, there are no fees, saving you money at closing.

- As-Is Sales: Sell your home in any condition without repairs, as South Florida Cash Home Buyers factors any necessary repairs into the cash offer provided.

South Florida Cash Home Buyers has earned a five-star rating on Facebook. However, they are not widely reviewed on major review platforms.

South Florida Cash Home Buyers operates in Miami Dade and Broward County, serving areas like Miami Gardens, North Miami Beach, and North Miami.

5. Florida Cash Home Buyers

- 15-120 Day closing (depends on package)

- 0 Commissions

- 0-20 Day contingency (depends on package)

Florida Cash Home Buyers offers a simple and convenient solution for homeowners looking to sell their properties without complications. They buy homes in any condition, regardless of location in Florida.

- Flexible Closing Options: Choose from 15 to 120 days, based on their different package options.

- Offer Appointment: Schedule an in-person or phone appointment with a Buying Manager, who will assess your property and provide the highest offer suited to your needs.

- As-Is Pricing: Offers are based on the property’s remodeled market value, with adjustments for necessary repairs.

- No Commissions or Closing Costs: You save on typical real estate fees, enhancing your net profit.

- Sell As-Is: Florida Cash Home Buyers accepts properties in any condition, including those with code violations or tax liens. They even specialize in inherited homes and offer probate assistance if needed.

- Quick Close or Extended Timeline: Close within three to 30 days or at a date that aligns with your schedule.

Florida Cash Home Buyers is rated with an average of 3.6 on Trustpilot and a 4.9 rating on Google Business.

Customers describe their experiences as smooth and professional. Natalia from Miramar appreciated the timely transactions, while Tene from Fort Lauderdale praised the support during a difficult time. Ronald Harvey, another client, noted the company’s reputable and efficient service.

With an A+ rating from the Better Business Bureau, Florida Cash Home Buyers is known for professionalism and reliability.

Florida Cash Home Buyers operates across Florida, including Miami, Fort Lauderdale, Palm Beach, Orlando, Jacksonville, Tampa, and nearby areas.

6. Florida Cash For Home

- Offer in 48 hours

- Close in 7 days

- $30,000 direct cash deposit

Florida Cash for Home provides a straightforward cash buying solution, inspecting properties and presenting offers within 48 hours.

- Quick Cash Offer: Receive a fair offer within 48 hours, following a complete property inspection.

- Fast Closing: Close the sale within seven days, streamlining the process for urgent sellers.

- Unique Cash Deposit: Receive up to $30,000 as a direct deposit upon acceptance, fostering trust between seller and buyer.

- Speedy Sale: Sell your home within seven days, even if it needs repairs.

- No Closing Costs: Florida Cash for Home covers all closing fees, adding convenience and savings.

- Direct Cash Payment: Receive up to $30,000 directly in cash as part of their unique buying process.

- Flexible Closing Date: Close on a date that suits your schedule, offering full flexibility.

Florida Cash For Home is well-regarded for professionalism and efficiency, particularly in helping homeowners facing foreclosure or needing to sell quickly. They hold a 4.3-star rating on Google Business, with customers noting fast offers, fairness, and ease in handling legal and banking matters.

Florida Cash for Home serves homeowners in Miami, Fort Lauderdale, and Palm Beach, specifically buying properties across Miami-Dade, Broward, and Palm Beach Counties.

7. We Buy Houses Florida

- Offer in 48 hours

- Close in 14 days

We Buy Houses Florida offers fast cash offers for homes, typically within 48 hours of the initial conversation and property viewing. They aim to close deals within 14 days, and occasionally as quickly as seven days if the title search is completed sooner.

- Closing Cost Coverage: They cover seller closing costs, helping save 2-3% of the purchase price in typical expenses.

- Flexible Payment Options: Offers may increase if the seller agrees to terms like taking over mortgage payments or seller financing.

- Offer Range: Offer values range from 20% to 50% below retail, adjusting for location, property condition, and repair needs.

- Accepts Any Property Condition: We Buy Houses Florida purchases properties regardless of condition, addressing issues like foreclosure, bankruptcy, and more.

- Variety of Real Estate Types: They buy all types of real estate, including homes, apartments, land, and commercial buildings.

- Assistance for Special Circumstances: They handle properties in complex situations, offering solutions for landlords, divorced homeowners, and those with difficult property conditions.

We Buy Houses Florida has received positive feedback from sellers across the state. Customers praise their quick responses, professional service, and ease of transactions, particularly when facing foreclosure or time-sensitive sales.

However, reviews are mixed with those from other locations, as this company operates nationally. They hold an average rating of 4.5 across platforms like Google and Yelp.

We Buy Houses Florida operates throughout the state, focusing on central areas like Orlando, Tampa, and Sarasota, and leveraging a network of investors to ensure fast sales.

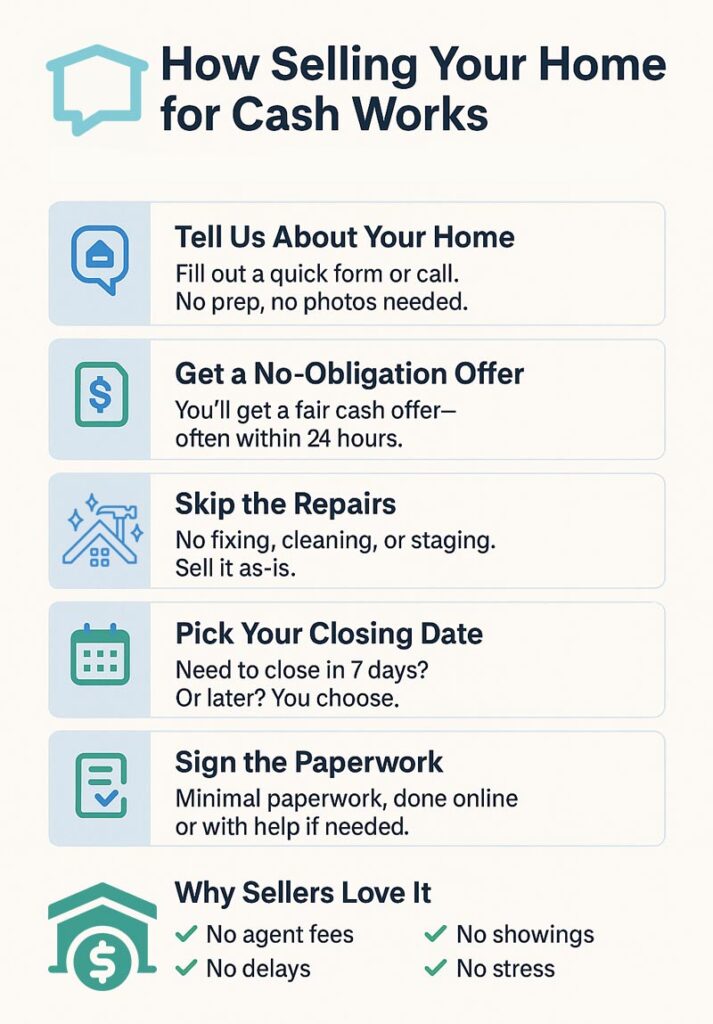

How Cash Home Buyers Work in Florida

Thinking about selling your home for cash in Florida? Here’s how it usually goes:

1. You Share Your Property Info

Start by filling out a quick online form or calling a local investor. They’ll ask about your home’s condition, size, and location.

2. You Get a Cash Offer

Within 24–48 hours, most companies will give you a no-obligation cash offer. Some might even send a rep to see the property first.

3. You Accept (Or Don’t)

You can take the offer, ask for changes, or walk away. No pressure.

4. Title & Escrow Process Starts

In Florida, real estate closings are typically handled by title companies, not attorneys. The state does not require a lawyer to be involved in residential property transactions. Title companies manage tasks like title searches, preparing closing documents, and issuing title insurance. However, they cannot provide legal advice or draft certain legal documents unless they’re attorney-owned .

5. You Close & Get Paid

Most deals wrap up in 7–14 days. You get your money via check or wire transfer.

A Few Florida-Specific Tips

- Title companies handle closings: In Florida, licensed title companies usually manage the closing process, including the title search and paperwork. Attorneys aren’t required but can be hired for legal advice.

- Property taxes are prorated: Florida property taxes are paid at the end of the year. If you sell before they’re due, your share of the year’s taxes will be credited to the buyer at closing.

- Disclosure laws focus on what you know: Florida requires sellers to disclose known material defects that aren’t easily visible. If you know about issues like mold, roof leaks, or plumbing problems, you have to disclose them—but you don’t have to go looking for hidden problems.

- Flood zones matter: Many areas in Florida are flood zones. If your property is in one, the buyer’s lender may require flood insurance, and buyers often ask about recent flooding or storm damage.

Pros & Cons of Selling for Cash

Selling your home for cash in Florida can be a game changer—but it’s not for everyone. Here’s what to weigh before you decide:

✅ Pros

- Fast Closings: Many cash buyers can close in 7 to 14 days, sometimes even sooner.

- No Repairs Needed: Most will buy your home as-is, even if it needs serious work.

- Skip the Showings: You won’t need to clean up or stage your house for buyers.

- Fewer Fees: No agent commissions or seller-paid closing costs in many cases.

- Less Stress: No financing fall-throughs, appraisals, or long waiting periods.

⚠️ Cons

- Lower Offer Price: Cash offers are usually below market value—often 10–30% less.

- Watch for Scams: Some “We Buy Houses” companies use high-pressure or shady tactics.

- Limited Negotiation: Most buyers give take-it-or-leave-it prices with little wiggle room.

Tips to Vet ‘We Buy Houses’ Companies

Not all cash buyers are the same—and some are definitely better than others. Before signing anything, use these tips to stay safe and make a smart move:

1. Check Online Reviews

Look for recent Google, Facebook, or Trustpilot reviews. Do sellers say the process was easy and fair?

2. Verify They’re Real

Make sure the company has a real website, a working phone number, and a local address. If something feels off—it probably is.

3. Ask About Fees

A legit buyer should be upfront about closing costs, commissions (if any), or service fees.

4. Don’t Rush It

If a company pressures you to “sign now or lose the deal,” that’s a red flag. Take your time.

5. Know Who You’re Dealing With

In Georgia, franchises like “We Buy Houses” vary by location. Make sure you know which office you’re working with—and who owns it.

6. Confirm They Buy in Your Area

Some buyers only cover big cities. If you’re in a smaller town, double-check that they actually serve your zip code.

Sell Smart. Sell Fast. Start Here.

Selling your house for cash in Florida doesn’t have to be complicated or risky. Whether you’re facing major repairs, moving fast, or just want to skip the traditional process, there’s a better way.

iBuyer.com offers a direct, no-hassle solution for homeowners who need speed and certainty. You can get a real cash offer, skip showings, and close in days—not months.

Here’s what you get with iBuyer.com:

- A fast, no-obligation cash offer straight from a trusted buyer

- The option to work with a certified home sale partner near you

- A simple process with no fees, no repairs, and no surprises

Thousands of Florida homeowners are choosing this faster, simpler way to sell. Now it’s your turn.

Instant Valuation, Confidential Deals with a Certified iBuyer.com Specialist.

Sell Smart, Sell Fast, Get Sold. No Obligations.

Sell Your Home For Cash in Your Area

- Companies That Buy Houses For Cash in Boca Raton

- Companies That Buy Houses For Cash in Bradenton

- Companies That Buy Houses For Cash in Cape Coral

- Companies That Buy Houses For Cash in Davie

- Companies That Buy Houses For Cash in Daytona Beach

- Companies That Buy Houses For Cash in Fort Lauderdale

- Companies That Buy Houses For Cash in Fort Myers

- Companies That Buy Houses For Cash in Gainesville

- Companies That Buy Houses For Cash in Jacksonville

- Companies That Buy Houses For Cash in Kissimmee

- Companies That Buy Houses For Cash in Lakeland

- Companies That Buy Houses For Cash in Lehigh Acres

- Companies That Buy Houses For Cash in Longwood

- Companies That Buy Houses For Cash in Melbourne

- Companies That Buy Houses For Cash in Miami

- Companies That Buy Houses For Cash in Ocala

- Companies That Buy Houses For Cash in Orlando

- Companies That Buy Houses For Cash in Palm Bay

- Companies That Buy Houses For Cash in Pensacola

- Companies That Buy Houses For Cash in Sarasota

- Companies That Buy Houses For Cash in St Petersburg

- Companies That Buy Houses For Cash in Tallahassee

- Companies That Buy Houses For Cash in Tampa

- Companies That Buy Houses For Cash in West Palm Beach

FAQs about Florida Cash Buyers

Selling your home to a cash buyer offers several benefits. The process is significantly quicker, with transactions often closing in as little as 7-14 days. There is no need to invest time or money in repairs, as cash buyers purchase homes “as-is.” This option can also help you avoid foreclosure by providing a swift way to pay off your mortgage. Overall, the process is straightforward and involves less hassle compared to traditional sales.

Cash home buyers consider several factors when determining their offer price. They evaluate current market conditions and trends in your area, assess the overall condition of your property, and take into account the desirability and convenience of your home’s location. Additionally, they look at comparable sales, which are prices of similar homes that have recently sold in your neighborhood.

Reputable cash buyers typically do not charge hidden fees. It is important to ask upfront about any costs involved and carefully review the purchase agreement to ensure there are no unexpected charges. Choosing a well-reviewed and highly-rated cash buyer can also help avoid any hidden fees.

The average timeline for closing a cash sale ranges from 7 to 14 days, depending on the buyer and the specific circumstances of your property. This speed is one of the major advantages of selling to a cash buyer.

Yes, most cash buyers purchase homes “as-is.” This means you can sell your home without making any improvements or renovations. Cash buyers are typically prepared to handle properties in various conditions.

Commonly required documents include the property deed, which proves ownership, your mortgage statement detailing the current mortgage balance, and your property tax statement showing any outstanding property taxes. Additionally, valid identification for all sellers will be necessary.

To verify a cash buyer’s legitimacy, you can check their ratings on Trustpilot, read online reviews from past sellers, and confirm any necessary licenses or accreditations. These steps can help ensure you are dealing with a reputable buyer.

Reilly Dzurick is a seasoned real estate agent at Get Land Florida, bringing over six years of industry experience to the vibrant Vero Beach market. She is known for her deep understanding of local real estate trends and her dedication to helping clients find their dream properties. Reilly’s journey in real estate is complemented by her academic background in Public Relations, Advertising, and Applied Communication from the University of North Florida.